Factory cost is also known as works cost, production cost, or manufacturing cost. However, in management terminology, cost refers to expenditure and not to price. If you produce more cars, you need to employ more workers; this is a variable cost. However, even if you didn’t produce any cars, you may still need some workers to look after an empty factory.

Create a Free Account and Ask Any Financial Question

- They were right,” explained William A. Galston, an expert at the Brookings Institution, on Wednesday.

- Sometimes, the normal operations of a business must be suspended temporarily due to unfavorable market conditions, strikes, or other forces.

- It is a predetermined calculation of how much costs should be under specified working conditions.

- These types of costs help in determining pricing strategies and profit margins.

- Direct costs are expenses directly attributable to producing goods or services, such as raw materials or labor.

That is to say, they are determined after goods have been manufactured or services have been rendered. Production costs refer to costs that arise in the course of acquiring, processing, and using raw materials. In this category, costs are classified based on whether they are normally incurred at a particular level of output under the conditions for which that level of output is normally attained. Direct costs are costs that can be directly and easily traced to (or identified with) a product, process, or department.

Browse more Topics under Fundamentals Of Cost Accounting

For example, interest on capital, though not actually payable, must often be included to judge the relative profitability of two products involving unequal outlays of cash. Thus, the opportunity cost of yarn produced by a composite spinning and weaving mill, which is used in the weaving section, would be the price that could have been definition of adjusted gross income obtained by selling the yarn in the market. In making this decision, the depreciation of the vehicles is not to be considered but the management must take into account the present expenditure on fuel, maintenance, and driver salaries. Management decisions are directly affected by such costs because they give rise to cash expenditure.

Learning Activities

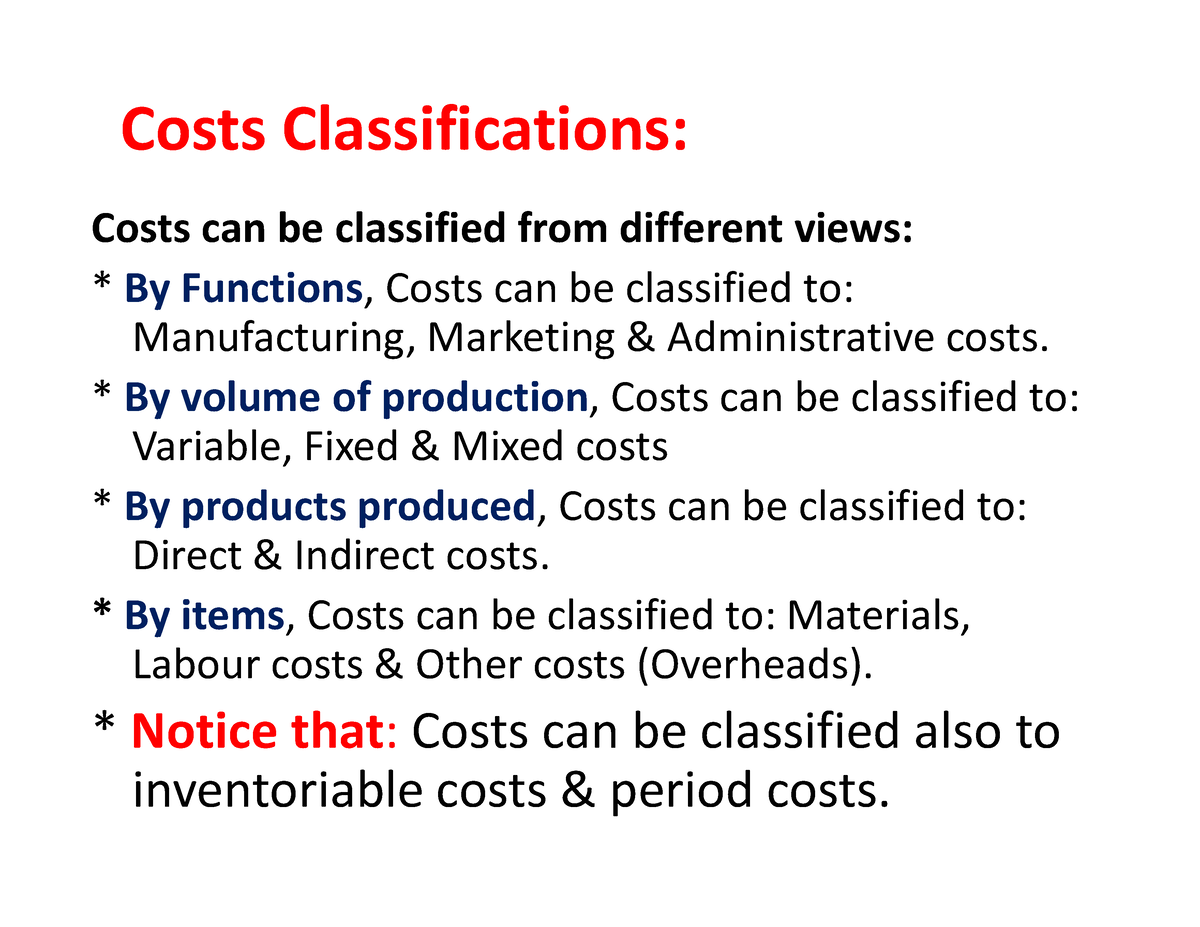

Costs can be classified based on several criteria such as nature of cost, elements of cost, controllability of cost, function or department from where the cost is incurred, etc. Examples of shut-down costs include rent for factory premises, salaries of top management, and so on. During the suspension of production or other activities, certain costs may still need to be incurred, and these are considered ‘shut-down costs’. When choosing an alternative increases total costs, such increased costs are known as incremental costs. Historical costs are costs that are identified after they have been incurred.

Do you own a business?

Organisations tend to utilise their limited resources for the most productive alternative and forgo the income expected from the second-best use of these resources. In this course, we will cover many cost classifications useful for planning and control. We will introduce the basic concepts behind these classifications but you will use them (and get in greater depth) in other chapters. The cost of services provided to an undertaking and the notional cost of using owned assets (i.e., depreciation of an owned factory building). The unavoidable costs are ‘inescapable costs’ which are essentially to be incurred, within the limits or norms provided for.

Frog urns are available in a wide range of materials, each with its own unique properties and aesthetic appeal. For example, ceramic urns offer a classic and timeless look, while metal urns can convey a more modern and sleek design. If you’re looking for a more eco-friendly option, consider urns made from sustainable materials like bamboo or biodegradable plant-based composites.

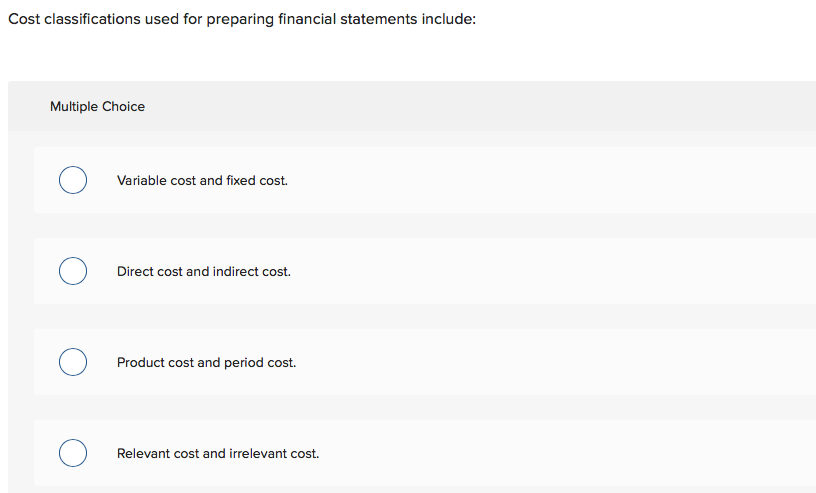

This forms of classification contribute to proper allocation of costs for decision-making as well as for reporting purposes. Such detailed classification enables a business enterprise to analyze the expenses structurally. Cost accounting focuses on a business’s costs and uses the data on costs to make better business decisions, with the goal of reducing costs and improving profitability at every stage of the operational process. Financial accounting is focused on reporting the financial results and financial condition of the entire business entity.

Depreciation, is a notional cost in which no cash transaction is involved. Book costs can be converted into out of pocket costs by selling the assets and having them on hire. These costs cannot be influenced by the action of a specified member of the organization. The controllability of cost depends upon the level of responsibility under consideration. The uncontrollable cost is a cost that is beyond the control (i.e., uninfluenced by actions) of a given individual during a given period of time.

These are the costs a company gets involved in to maintain its reputation and after-sale service for the customers. The company then evaluates this information about the individual consumers to increase profitability and customer targeting. Standard cost – predetermined cost based on some reasonable basis such as past experiences, budgeted amounts, industry standards, etc.